Companies with the best and the worst technicals.

Lists of companies in NSE500 with the best and the worst technicals...

Lists of companies in NSE500 with the best and the worst technicals...

Lists of companies in NSE500 with the best and the worst fundamentals...

List of the latest important filings for NSE500....

This article analyzes the recent trends in GST collections, inflation rates, and...

This article explores the recent actions taken by SEBI against financial influencers...

This article explores the critical role of cybersecurity measures in India's financial...

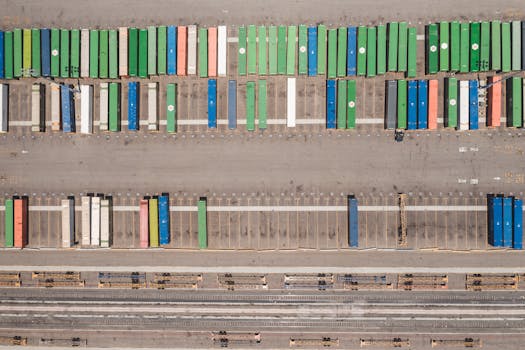

The landscape of global trade is undergoing significant transformations, particularly in the wake of geopolitical disruptions, supply chain uncertainties, and the pressing need for more localized manufacturing. In this dynamic environment, Indian electronics manufacturers are positioning themselves as key beneficiaries of these global trade realignments, thanks in part to robust government incentives aimed at enhancing domestic production.

The Indian electronics market is expected to reach a valuation of $300 billion by 2026, growing from $75 billion in 2020, according to a report by the India Electronics and Semiconductor Association (IESA). This impressive growth trajectory is reflective of India's ambition to not only meet domestic demand but also to emerge as a competitive player in the global electronics supply chain. The government's vision, articulated through its Make in India initiative launched in 2014, has been pivotal in fostering investments and promoting local manufacturing.

To further catalyze this growth, the Indian government has introduced a series of incentives designed to attract both domestic and foreign investment into the electronics sector. The Production-Linked Incentive (PLI) scheme, announced in 2020, allocates ₹40,951 crore (~$5.6 billion) to encourage companies to manufacture mobile phones, semiconductor components, and other electronic goods. This scheme aims to target large multinational corporations and incentivize them to set up manufacturing units in India.

As of 2023, major manufacturers such as Apple, Samsung, and Xiaomi have already begun scaling up their production capabilities in India, resulting in a reported increase in exports. For instance, Apple’s contract manufacturers, including Wistron and Foxconn, have ramped up production to achieve a target of exporting $5 billion worth of iPhones alone by the end of 2023.

The ongoing trade tensions between the United States and China have further propelled Indian manufacturers into the spotlight. U.S.-based companies are increasingly looking to diversify their supply chains to reduce reliance on Chinese manufacturing. This shift has opened avenues for Indian manufacturers, as they offer an alternative base for production. In fact, a report by Deloitte indicates that about 30% of global electronics manufacturing capacity could shift from China in the next five years, with India poised to capture a significant share of this market.

While consumer electronics have stolen the limelight, it is essential to note that Indian manufacturers are also making inroads into other high-tech electronics segments. The manufacturing of components for electric vehicles, aerospace, and telecommunications has gained traction. The Indian automotive industry, particularly with the rise of Electric Vehicles (EVs), is projected to generate a demand for electronics worth $70 billion by 2030. Companies like Tata Motors and Mahindra Electric have already begun to localize component manufacturing to capitalize on this trend.

The Indian electronics sector received Foreign Direct Investment (FDI) worth $10.4 billion in the financial year 2021-2022 alone, marking a 25% increase from the previous year. The rising inflow of foreign investments is closely tied to the government’s push for reforms and the commitment to improving the ease of doing business. Going forward, the Indian government estimates that the PLI scheme alone could generate over 1 million jobs in the electronics manufacturing sector by 2025, as per estimates by the Ministry of Electronics and Information Technology (MeitY).

Despite these promising developments, Indian manufacturers must navigate a complex landscape filled with challenges including infrastructure deficits, stringent quality control norms, and skill shortages in the labor market. Continued engagement between industry stakeholders and the government will be essential to address these challenges.

As the world increasingly gravitates towards a multi-polar trade environment, Indian electronics manufacturers are uniquely positioned to benefit from a combination of strategic government incentives and the broader realignment of global supply chains. By leveraging these advantages, India can not only strengthen its own economic landscape but also emerge as a formidable player in the global electronics market.

This article explores the robust growth of the gaming and esports industry...

This article explores how fintech platforms like Jio Payments Bank and PayNearby...