Companies with the best and the worst fundamentals.

Lists of companies in NSE500 with the best and the worst fundamentals...

Lists of companies in NSE500 with the best and the worst fundamentals...

List of the latest important filings for NSE500....

Lists of companies in NSE500 with the best and the worst technicals...

The article examines the profound effects of the U.S. government shutdown on...

The article discusses the recent rise in safe-haven assets, including the all-time...

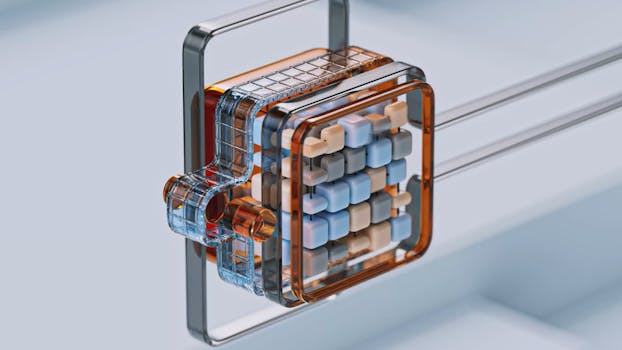

The partnership between OpenAI, Samsung, and SK Hynix signifies a transformative moment...

Economic decision-making is a complex interplay of various indicators that signal the health of the economy. For the Federal Reserve (Fed), these indicators include job reports, inflation metrics, and other economic data. However, when critical reports are delayed or unavailable—such as in the case of a government shutdown—the Fed faces formidable challenges. The absence of timely data can hinder the effectiveness of policy adjustments necessary to maintain economic stability.

One of the most pivotal reports the Fed relies on is the monthly job report, which provides crucial insights into employment trends. According to data from August 2025, the unemployment rate stood at 4.3%, a slight increase from 4.2% in July. Job openings across the economy amounted to 7.227 million in August, reflecting a slight increase from July's figure of 7.208 million. These figures would typically inform Fed deliberations on monetary policy. However, if such reports were delayed, analysts would have to rely on outdated information, potentially leading to policy missteps.

Inflation plays an essential role in how the Fed sets interest rates. The Consumer Price Index (CPI) for all urban consumers was reported at 323.364 in August 2025, up from 322.132 in July. However, if inflation metrics are not available, the Fed could find itself unprepared for inflation spikes, adversely affecting savings, investments, and consumption. Inflation influences interest rates, which in turn dictate borrowing costs across sectors, thereby shaping the broader economic environment.

Without key economic data, financial markets may react in unpredictable ways. For instance, the 10-year Treasury yield was reported at 4.1% as of October 2, 2025. A sudden lack of clarity from the Fed due to absent data could lead to increased market volatility. Investors, lacking guidance, may pull back on risk, affecting everything from the stock market to commodity prices.

The Fed utilizes a range of economic data to adjust its monetary policy, including measures of money supply. For example, as of August 2025, the M2 money stock was reported at $22,195.4 billion, an increase from $22,115.8 billion in July. This provides an essential measure of liquidity in the economy. In a shutdown or when critical data is unavailable, the Fed may find itself making decisions that could either overestimate or underestimate the status of money supply, driving interest rates either too high or too low wrongly.

Consumer sentiment is another vital indicator that guides the Fed in its decision-making. For August 2025, the University of Michigan's Consumer Sentiment Index stood at 58.2, down from 61.7 in July. The Fed scrutinizes consumer behavior to preemptively adjust interest rates. An absence of real-time data on consumer sentiment could inhibit the Fed’s ability to respond effectively to consumer spending trends, which drive economic growth.

The unavailability of key economic data can also compromise the Fed's credibility. If the public sees the Fed as acting without adequate information, it can undermine confidence in monetary policy. For instance, commentary surrounding the Fed's Effective Federal Funds Rate, which was 4.22% as of September 1, 2025, may receive skepticism. Many stakeholders would question if rate adjustments are justified without comprehensive data, potentially leading to a self-fulfilling prophecy of economic unease.

The Fed must also consider the health of commercial banks during these times. Commercial and industrial loans issued by all commercial banks amounted to $2,685.294 billion in August 2025, compared to $2,675.2018 billion in July. A sudden lack of guidance can affect banks' lending behaviors, impacting overall economic growth. If banks do not receive adequate signals from the Fed, they risk tightening credit availability inadvertently, which could dampen business expansion and consumer spending.

In a nutshell, the absence of timely economic data places the Fed in a precarious situation where reactions must be more calculated. Missteps can delay economic recovery, exacerbate inflation concerns, or deter consumer spending. In the absence of accurate, up-to-date data, the risk of overreacting or underreacting increases, which could spiral into broader economic consequences.

Given such potential pitfalls, it is essential for the Fed to rely on alternative data sources, including private sector analytics and high-frequency data, to make informed decisions during periods of uncertainty. Moreover, enhancing communication strategies becomes paramount, ensuring that the public and markets understand the context behind Fed actions even when data is scarce. This proactive approach can help to maintain market confidence and uphold the intended effects of monetary policy interventions.

A comprehensive analysis of the current trends in China's housing market, highlighting...

The article analyzes the immediate impact of the U.S. federal government shutdown...